Life Insurance in and around Los Altos

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

Can you guess the price of a typical funeral? Most people aren't aware that the mean cost of a funeral in America is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If your family cannot cover those costs, they may fall on hard times following your passing. With a life insurance policy from State Farm, your family can thrive, even without your income. Whether it pays off debts, pays for college or keeps paying for your home, the life insurance you choose can be there when it’s needed most by your loved ones.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Love Well With Life Insurance

Some of your options with State Farm include coverage for a specific time frame or level or flexible payments with coverage designed to last a lifetime. But these options aren't the only reason to choose State Farm. Agent Josh Anderson's attention to customer service is what makes Josh Anderson a great asset in helping you select the right policy.

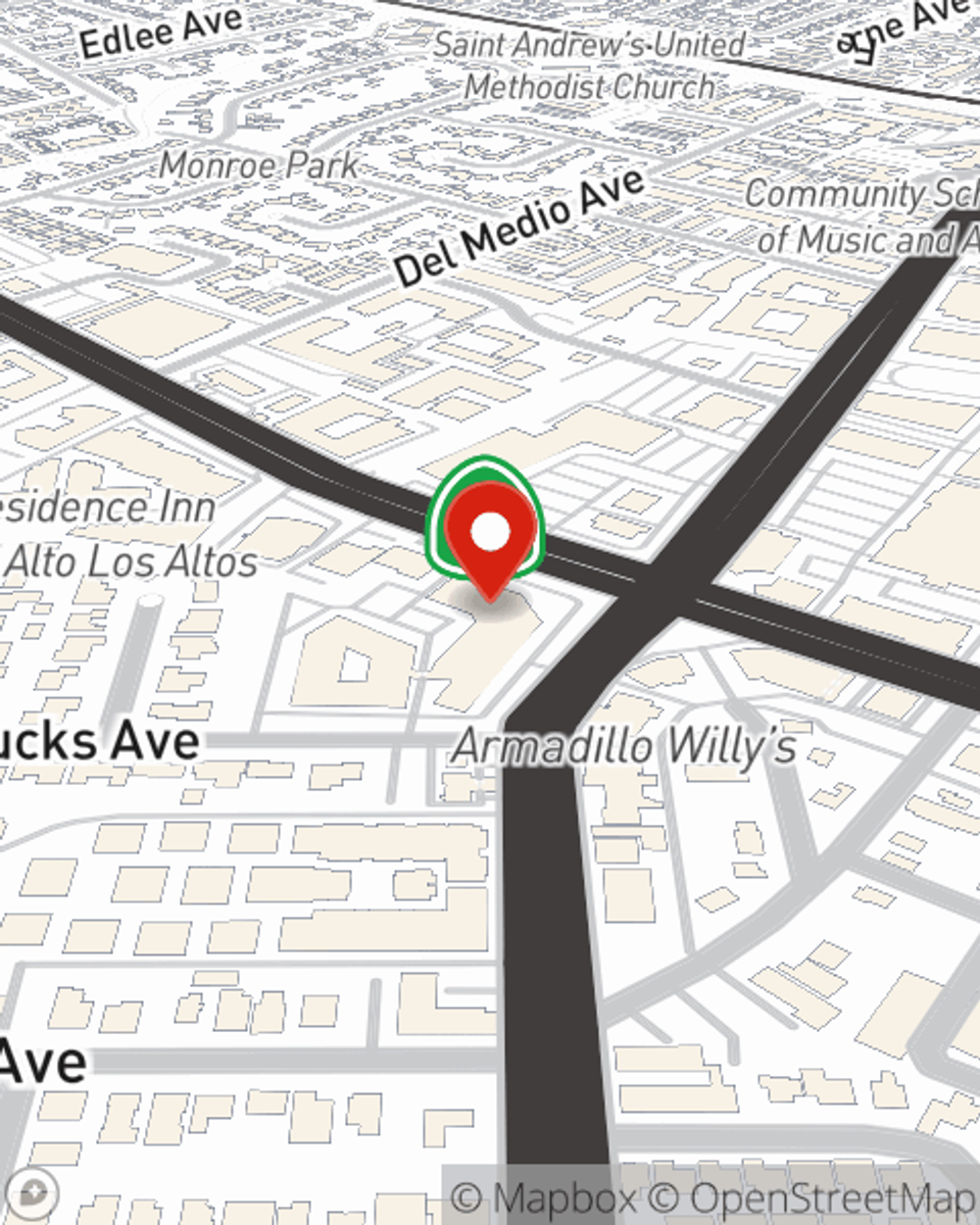

Interested in finding out what State Farm can do for you? Visit agent Josh Anderson today to get to know your individual Life insurance options.

Have More Questions About Life Insurance?

Call Josh at (650) 209-1224 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Josh Anderson

State Farm® Insurance AgentSimple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.